Facebook just announced its latest round of “coordinated inauthentic behavior,” this time out of Iran. The company took down 262 Pages, 356 accounts, three Facebook groups and 162 Instagram accounts that exhibited “malicious-looking indicators” and patterns that identify it as potentially state-sponsored or otherwise deceptive and coordinated activity.

As Facebook Head of Cybersecurity Policy Nathaniel Gleicher noted in a press call, Facebook coordinated closely with Twitter to discover these accounts, and by collaborating early and often the company “[was] able to use that to build up our own investigation.” Today, Twitter published a postmortem on its efforts to combat misinformation during the US midterm election last year.

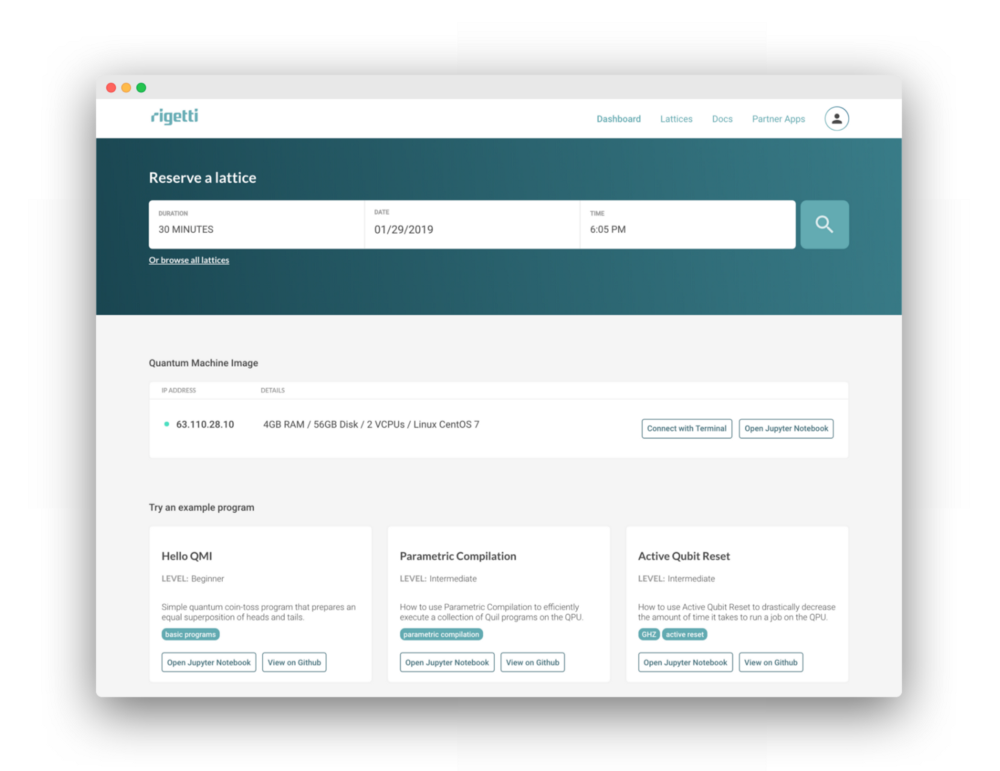

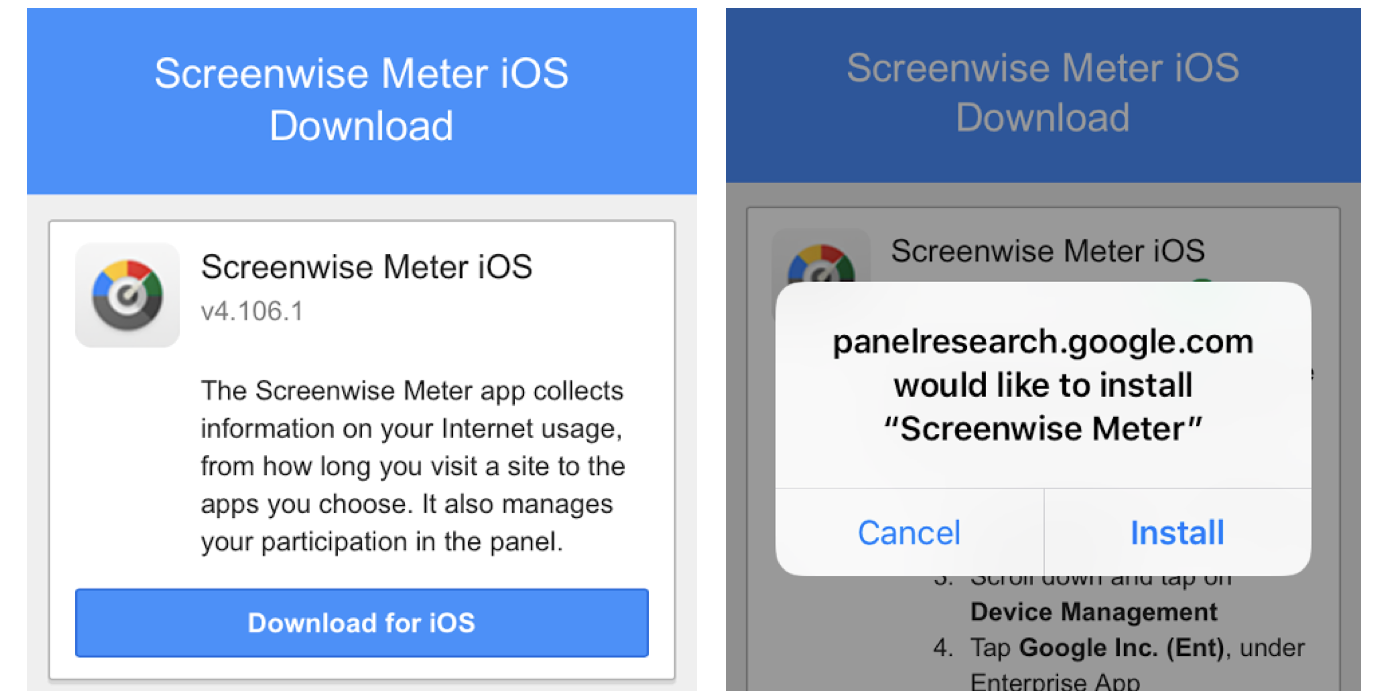

Example of the content removed

As the Newsroom post details, the activity affected a broad swath of areas around the globe:

“There were multiple sets of activity, each localized for a specific country or region, including Afghanistan, Albania, Algeria, Bahrain, Egypt, France, Germany, India, Indonesia, Iran, Iraq, Israel, Libya, Mexico, Morocco, Pakistan, Qatar, Saudi Arabia, Serbia, South Africa, Spain, Sudan, Syria, Tunisia, US, and Yemen. The Page administrators and account owners typically represented themselves as locals, often using fake accounts, and posted news stories on current events… on topics like Israel-Palestine relations and the conflicts in Syria and Yemen, including the role of the US, Saudi Arabia, and Russia.

Today’s takedown is the result of an internal investigation linking the newly discovered activity to other activity from August. Remarkably, the activity Facebook flagged today dates back to 2010.

The Iranian activity was not focused on creating real world events, as we’ve seen in other cases. In many cases, the content “repurposed” reporting from Iranian state media and spread ideas that could benefit Iran’s positions on various geopolitical issues. Still, Facebook declined to link the newly identified activity to Iran’s government directly.

“Whenever we make an announcement like this we’re really careful,” Gleicher said. “We’re not in a position to directly assert who the actor is in this case, we’re asserting what we can prove.”

Source: Tech Crunch

Mike Ybarra

Mike Ybarra (@XboxQwik)

(@XboxQwik)