Kleiner is known for many things. Among them, increasingly, is the growing number of people who’ve logged time at the firm, then struck out on their own to hang their own shingles.

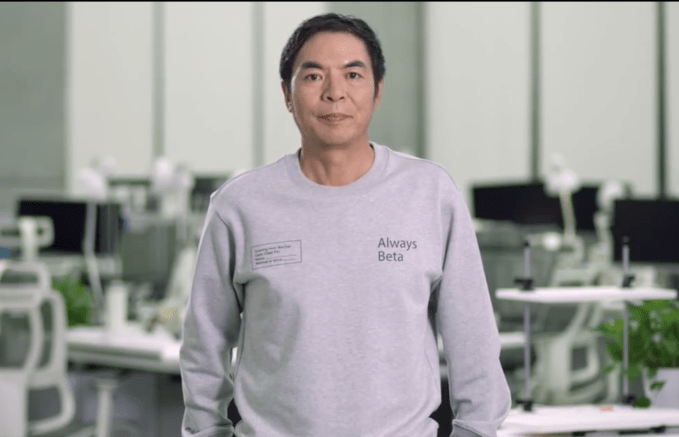

The latest among them: Lynne Chou O’Keefe, who joined Kleiner Perkins in 2013 as a partner in its life sciences group, where she focused on digital health and connected devices. Today, Chou O’Keefe is taking the wraps off a new firm, Define Ventures, and announcing a debut fund with $87 million in capital commitments.

We’d first written about the fund back in October, when we spied an SEC filing for it. As we reported then, Chou O’Keefe spent six years with Abbott Vascular, a division of the healthcare giant Abbott, as a global product manager and later as a global marketing director. She also logged a couple of years with Guidant (which is part of Boston Scientific and Abbott Labs) and, before that, worked in venture with Apax Partners.

That SEC filing listed a target of $65 million. But Chou O’Keefe, with whom we chatted on Friday, suggested that interest in the fund was even greater than imagined, thanks in part to investors she got to know through her work as a former board member of Livongo, a now publicly traded company that monitors and coaches patients with chronic diseases like diabetes.

Unsurprisingly, she says founders are also excited about her new firm, suggesting they’d been looking for a firm that doesn’t just dabble in digital health but that focuses expressly on it, as does Define Ventures .

“A lot of founders have said, ‘It’s so nice not to have to explain space to you.’ Having true partnerships is something they’ve needed and something you can do with a sector-focused fund.”

Define may be announcing its final fund close today, but the firm, which is interested in telemedicine startups and teams focused on chronic disease management, among others, has been actively investing in startups over the last year.

Among its bets so far: HIMS, the direct-to-consumer digital health and wellness company focused on men; Tia, a startup that plans to open membership-only women’s health clinics across the country, after opening its first location in New York last March; Verana Health, a clinical data startup that initially focused on ophthalmology but has been expanding into other areas; Unite Us, a care coordination software maker that looks to connect social services with healthcare; and Lightship, a startup that’s working to find and connect patients with the companies that need them for their clinical trials.

Though the lone general partner, Chou O’Keefe isn’t running the fund single-handedly. Helping her is principal Chirag Shah, who was most recently a vice president with Imagine Health, a Utah-based company that builds custom teams of healthcare providers for employers with large concentrations of employees in a single geography. He has also worked as a senior manager at the publicly traded company Castlight Health and as an associate with The Carlyle Group.

The two had numerous mutual connections, says Chou O’Keefe, adding that they plan to invest in between 15 and 18 startups altogether from their debut fund, writing checks that range from $750,000 on the earlier side to upwards of $6 million.

Whether Define proves smart to focus more narrowly on digital health will take time to know, but certainly, there’s growing interest in virtual healthcare across the board. According to one research outfit, Grand View Research, the global digital health market size is expected to reach $500 billion by 2025, expanding at a compound annual growth rate of roughly 27% between now and then.

In the meantime, Chou O’Keefe becomes part of a group of former Kleiner investors who are now in charge of their own destiny. Among other Kleiner alums who’ve since co-founded their own shops is Beth Seidenberg of Westlake Village Biopartners, Chi-Hua Chien of Goodwater Capital, Trae Vassallo of Defy, Mary Meeker of Bond and Aileen Lee of Cowboy Ventures, to name just a handful.

Source: Tech Crunch